Hey there, fellow taxpayer! If you’re like many Indians, you probably find yourself scrambling as the Income Tax Return (ITR) filing deadline approaches. But what if you missed it or need more time? Is the government extending the ITR deadline for AY 2025–26? Will you be charged a late fee?

In this complete and friendly guide, we’ll cover everything you need to know about the ITR filing deadline extension, including official updates, what happens if you miss the due date, late filing penalties, and what steps you can take right now to stay stress-free.

Let’s dive right in!

🔍 What Is the ITR Filing Deadline for AY 2025–26?

Before we talk about an extension, let’s clarify the standard due date.

| Taxpayer Category | Original Due Date (AY 2025–26) |

|---|---|

| Individual / Salaried Employee | 31st July 2025 |

| Businesses Requiring Audit | 31st October 2025 |

| Businesses Requiring Transfer Pricing Audit | 30th November 2025 |

These are the original due dates set by the Income Tax Department every year under the Income Tax Act.

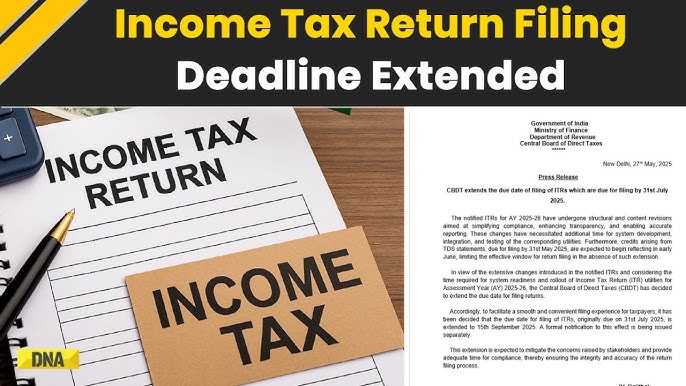

📰 Latest Update: Has the ITR Filing Deadline Been Extended in 2025?

As of July 2025, the Income Tax Department has NOT officially announced any extension to the ITR filing deadline for AY 2025–26.

However, based on trends from the past years, the government has extended the deadline due to:

- Technical glitches on the portal

- Natural disasters (like floods)

- COVID-19 disruptions (during 2020–2022)

- Appeals from CA associations and taxpayers

🟡 Pro Tip: Bookmark www.incometax.gov.in or follow official Income Tax Twitter/X handle @IncomeTaxIndia for the latest updates.

📚 Past Trends: Historical ITR Deadline Extensions

Curious to see if there’s a pattern? Here’s a quick look at how deadlines were extended in past years:

| Assessment Year | Original Deadline | Extended Deadline | Reason |

|---|---|---|---|

| AY 2024–25 | 31 July 2024 | No extension | Stable portal, no major issues |

| AY 2023–24 | 31 July 2023 | 31 August 2023 | Server overload, portal glitches |

| AY 2022–23 | 31 July 2022 | No extension | Smooth filing process |

| AY 2021–22 | 31 July 2021 | 31 December 2021 | COVID-19 impact |

| AY 2020–21 | 31 July 2020 | 10 January 2021 | Pandemic disruptions |

So, while extensions aren’t guaranteed, they do happen under special circumstances.

🤔 What Happens If You Miss the ITR Filing Deadline?

Let’s say 31st July rolls by and you haven’t filed your return. Here’s what happens next:

1. Late Filing Fee (Under Section 234F)

| Filing Date | Total Income Below ₹5 Lakh | Total Income Above ₹5 Lakh |

|---|---|---|

| Before 31st July 2025 | ₹0 | ₹0 |

| Between 1 Aug – 31 Dec 2025 | ₹1,000 | ₹5,000 |

| After 31 Dec 2025 | ₹1,000 | ₹5,000 |

So yes, even if the portal allows you to file after the due date, you’ll have to pay a penalty unless the government announces a waiver or extension.

2. Interest on Outstanding Tax (Section 234A)

If you owe taxes and haven’t paid them by the due date, you’ll be charged 1% interest per month (or part thereof) on the unpaid amount.

3. Loss of Carry Forward Benefit

If you have capital or business losses to carry forward, filing late will disqualify you from availing that benefit.

🧾 How to File a Belated ITR After the Deadline?

Don’t worry if you missed the original date. The law allows you to file a belated ITR up to 31st December 2025 (unless extended).

🔹 Steps to File a Belated Return:

- Visit incometax.gov.in

- Login using your PAN and password

- Select “File Income Tax Return”

- Choose Assessment Year 2025–26

- Choose “Belated Return” under the filing section

- Fill in income details, deductions, taxes paid

- Pay the applicable late fee (auto-calculated)

- Submit and e-verify

📢 Heads up: If you expect a refund, filing sooner—even belated—is better, because interest on refunds only accrues after the actual filing date.

📝 Common Reasons Why People Miss the ITR Deadline

Let’s be honest—life happens. You’re not alone if you missed the due date. Here’s why many do:

- Forgot or unaware of the deadline 😓

- Awaiting Form 16 or investment proofs

- Confusion over new vs old tax regime

- Errors in Form 26AS or AIS

- Delays from CA or tax preparers

- Portal errors or OTP not working

- Just plain procrastination 💤

If you’re nodding along, don’t beat yourself up. The good news is—it’s not too late!

✅ Who Should Definitely File, Even If Late?

You MUST file ITR—even belated—if:

- Your total income exceeds the basic exemption limit (₹2.5 lakh for most)

- You earned income from freelancing or business

- You want to claim a TDS refund

- You need proof of income for visa, loans, or government schemes

- You’ve carried forward capital losses in previous years

📞 Can You Request an ITR Filing Extension Personally?

Short answer: No.

Extensions are only issued centrally by the CBDT (Central Board of Direct Taxes) for all taxpayers. You cannot request a personal or individual deadline extension.

That said, representations by CA associations or business bodies (like FICCI, ASSOCHAM) sometimes influence an all-India extension.

✅ Tip: If you represent a business group, you can make formal appeals through professional bodies.

🧠 How to Avoid Missing the Deadline Next Time

Let’s make sure this doesn’t happen again! Here’s a quick checklist:

| ✅ Smart Filing Tips | 🚫 Avoid These Mistakes |

|---|---|

| Set calendar reminders in June | Waiting for the last week |

| Keep Form 16, AIS, 26AS ready | Assuming your CA will remind you |

| Link PAN with Aadhaar in advance | Ignoring Aadhaar-PAN linking |

| Use the mobile app for alerts | Forgetting e-verification step |

| File even if your income is nil | Thinking it’s optional |

🔐 Important Documents Needed for ITR Filing

Whether you’re filing before or after the deadline, make sure you have these ready:

- PAN card

- Aadhaar card (linked)

- Form 16 (from employer)

- Form 26AS (tax summary)

- AIS (Annual Information Statement)

- Bank account details

- Investment proofs (for deductions)

- Loan interest certificates (home, edu loan)

- Capital gains statements (if applicable)

⚠️ FAQs on ITR Filing Deadline Extension

1. Will the ITR filing deadline for AY 2025–26 be extended?

As of now, no extension has been announced. Keep checking the official website for updates.

2. What if the portal is down on the last date?

If the site crashes or slows, the government might consider an extension, but there’s no guarantee.

3. Can I file after 31st December 2025?

No, after 31st Dec, you cannot file unless a condonation request is accepted by the CBDT for genuine hardship.

4. Do salaried people need to file ITR if TDS is already deducted?

Yes! Filing ITR is mandatory even if your employer deducted full TDS.

5. Will I get a refund if I file late?

Yes, but interest on refund is lower if you file late.

📌 Final Thoughts: File Smart, File On Time!

The ITR filing deadline is important—not just for compliance but for your peace of mind. Whether you’re a salaried professional, freelancer, or small business owner, missing the deadline can cost you money and future opportunities.

If you’re still within the deadline—file now. If you’ve missed it—file belated and stay compliant.

🙌 Ready to File? Here’s Your Next Step!

👉 Visit www.incometax.gov.in

👉 Gather your documents

👉 File it yourself or get a CA

👉 E-verify and you’re DONE!

Still confused? Drop your questions in the comments or talk to a tax expert today. Let’s not make filing taxes harder than it needs to be!